The whole world is undergoing a housing shortage, but vacant homes are barely budging. The OECD‘s latest data drop shows 42 million of its 426 million homes are vacant. Yes, roughly one in ten homes in advanced economies are empty. There are literally years of housing supply being used as an alternative to gold.

Rather than pondering why it’s so attractive to have vacant homes, many countries doubled down on reasons to hoard. If we only build more homes and give the investors cheap money, there can be enough to hoard too, right? I mean, you almost tried, so partial points. Let’s take a look at how bad the issue has become.

Canada Has Over 1.3 Million Vacant Homes, About 6 Years Of Supply

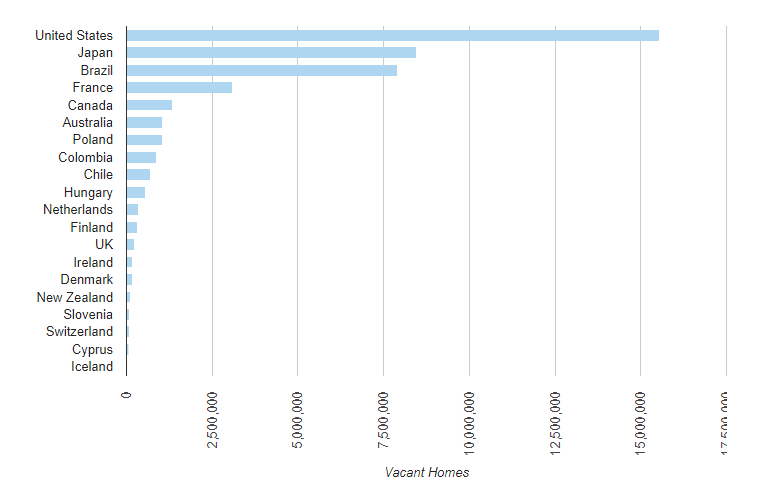

Canada has one of the highest numbers of vacant homes in the world. The OECD’s latest data shows 1.34 million homes were vacant, or about 8.7% of the country’s 15.41 million homes in total. That works out to nearly 1 in 12 homes, or 6 years of housing supply at the average construction rate from 2016 to 2019. Canada has the fifth most vacant homes of the group of advanced economies.

America Has The Most Vacant Homes In The World

U-S-A! U-S-A! The birthplace of the chicken-fried everything is also the king of vacant homes. The latest data shows 15.55 million homes were vacant, about 11.1% of the country’s 139.68 million homes. That works out to 1 in 9 homes, or nearly a decade of supply for the country. No other country is even close to that volume of vacant homes. Japan, notorious for its vacant homes, is in second, and it has nearly half the number.

Vacant Housing In OECD Countries

The most recent update for vacant homes for OECD countries that track housing vacancy.

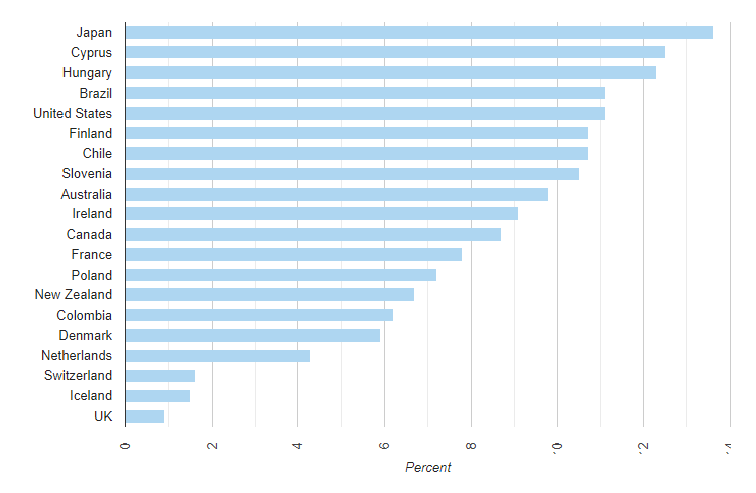

Japan Has The Highest Rate Of Housing Vacant, About 1 In 7 Homes

Speaking of Japan, the country tops the data set for the highest rate of vacant homes. The latest data shows 8.46 million homes were vacant, about 13.6% of the country’s 64.42 million homes in total. It’s about 1 in 7 homes vacant, which is a lot of frickin vacant homes. The country is less like its G7 peers, and more like an emerging market — Cyprus (12.5% vacant), Hungary (12.3%), and Brazil (11.1%). At least in regards to housing.

Vacant Housing Rates In OECD Countries

The most recent update for the rate of vacant homes in OECD countries that track housing vacancy.

Source: OECD; Better Dwelling.

Vacant Housing In The UK Is Annoying, But Comparatively Low

The UK is notable due to having relatively few vacant homes for an advanced economy. The latest data shows 225,845 vacant homes, just 0.9% of the country’s 24.41 million homes in total. In contrast to other countries, having 1 in 108 vacant homes seems like a lot less of a problem. It’s still a problem though, so if you’re a part of our rising UK readership, no need to fire off an angry email. It’s just not as big of an issue as it is in say, the US or Canada.

The methodology used in the UK highlights some issues across the board though. Their number doesn’t consider a second home vacant, which is the issue in many regions. When second homes are included, the rate doubles the OECD reported numbers. That said, this underplays the issue of vacant homes. Global numbers are likely to be slanted to a lower estimate. Sandbagging numbers might make people feel more comfortable, but won’t resolve the issue.

Incentives Are Slanted To Having Vacant Homes

Why keep a home vacant? There are a lot of reasons, but incentive is one of the biggest. Countries with the most vacancies have low carrying costs, and welcome foreign capital. Most of these countries don’t even collect beneficial ownership data, which is wild. In non-technical terms, it means they don’t want to know who the real owner of the home is, just someone to contact.

When prices advance faster than carrying costs, it makes sense to hold vacant homes. Especially in a housing crisis, since it creates an artificial supply shortage. The vacant units don’t just rise in value, they also contribute to the rise in home prices.

The UK’s Low Vacancy Rate Might Be Due To High Carrying Costs

High carrying costs might explain why the UK, which has seen high price growth, has so few vacant homes. The country’s policies are somewhat hostile to property investors these days. This makes it a much less attractive place to hold a vacant property. Especially considering there are so many other places to hold vacant property.

Take the UK’s non-resident speculator taxes. UK housing has been subject to a Non-Resident Capital Gains Tax (NRCGT) of 18% to 28% since April 2015. This was extended to non-housing in 2019. That’s right, it’s applied to the sale price, not the purchase price. If applied to the purchase price, who cares? It helps drive up the cost of housing by limiting supply, meaning you can still make out like a bandit after a few years.

In addition, property owned by “non-natural persons” (e.g. companies, etc.) are subject to an annual tax. The Annual Tax on Enveloped Dwellings (ATED) adds a point to annual carrying costs for homes over £500,000. Remember, if your annual costs rise higher than carrying costs, you lose money every year.

On top of that, you’re not going to want to keep that pricey property handed down to you. The UK also has an inheritance tax for gains over the £325,000 threshold. This makes passing on property less of an ideal store of wealth than a company.

Oh yeah, they also collect beneficial ownership information these days. Originally the UK had no idea who owned what, a relic from days past so Royalty could hide their wealth. The Queen even lobbied for exemptions, since they don’t want you to know how much cash they have stashed. Over the years, more and more transparency was adopted. It’s now generally a bad idea to stash your drug cash in UK homes at this point. Especially when there are more attractive options, like many of the Queen’s Commonwealth countries that still don’t collect that info.

Canada Is An Ideal Place To Hoard Vacant Property

Canada might have non-resident taxes, but they’re mostly just a PR tool to dismiss the issue. The taxes only apply to a small region, which can be avoided by investing outside of the boundary. The country’s re-elected leadership promised to outright ban non-resident purchasing. However, they have no idea who is a non-resident, and would prefer to keep it that way.

Canada has no beneficial registry, with BC being a recent exception to the rule. There’s no way to tell who ultimately owns a property, just the person to contact. Setting up an entity such as a corporation or trust web can ultimately circumvent that. Or at least obfuscate it to the point where it’s impossible to tell who actually owns it. Some experts acknowledge this is true, but dismiss it as “too complicated.” Yeah… paying $10,000 in legal fees to avoid paying a six-figure tax bill is certainly something a rich person would never do.

I tend to disagree with that narrative, since that’s not the data we’ve been looking at. A Transparency International study on Canadian real estate (which I was lucky enough to assist with) found this is a huge problem. It found $28.5 billion in mortgages registered to corporate entities from 2008 to 2018. That was just in Greater Toronto, not across the country. Are they owned by the mom and pop investor with a couple of investment properties, or transnational drug king pins with a lot more to spend?

No one knows, because Canada goes out of its way to make sure that data isn’t known. That sure doesn’t stop the government from declaring it domestic though. What’s the term? Wilful Blindness? Anyway, the point is this renders the measure as a vacancy deterrent useless.

Canada also has notoriously low property tax rates AND cheap money. Usually it’s one or the other, but the combination is like asking you to hold homes vacant. It’s a country with sub 1% property taxes, a central bank pushing mortgages below 2%, and 4% inflation. You would have to be an idiot not to hold vacant property with this setup.

The lack of inheritance tax also means if you inherit someone’s primary residence, you pay nothing. Personally, I’d be hoarding property as well if that was my setup in Canada. Especially in the “always goes up” environment it’s trying to create.

Fixing The Incentives To Hold Vacant Housing Will Be Like Unleashing Years Of Supply

Vacant housing might not seem like such a big deal in a higher rate environment. High rates mean needing to put property to the best use, since carrying costs increase profit risk. The current low rate setup is ideal for building up a portfolio of vacant properties though. If prices rise fast enough, you can even borrow cheap debt against the vacant property to realize the wealth. Or buy another property, as is the Canadian way.

This isn’t an accident. Some of the wealthiest people in the world are being advised to do this. It exploits a well-intended tax policy designed to “help” families. In reality, it makes it worse. It’s hard to convince the people on the wrong end of property speculation that more expensive debt makes housing cheaper though.

Years of supply are sitting unused as policymakers try to build enough to “catch up.” None realize accelerating supply in a short period places excess demand on construction. This drives the cost of building homes higher, thus making housing more expensive.

They also don’t seem to realize they’re printing money faster than housing can be built. This arms investors with a supply of capital, ready to scoop up property faster than they can be built. For example, investors are capturing over a quarter of Toronto’s housing supply. Or maybe they do realize these things, and they’re just hoping the people impacted don’t.

Source: betterdwelling.com

Leave A Comment